high low method machine hours

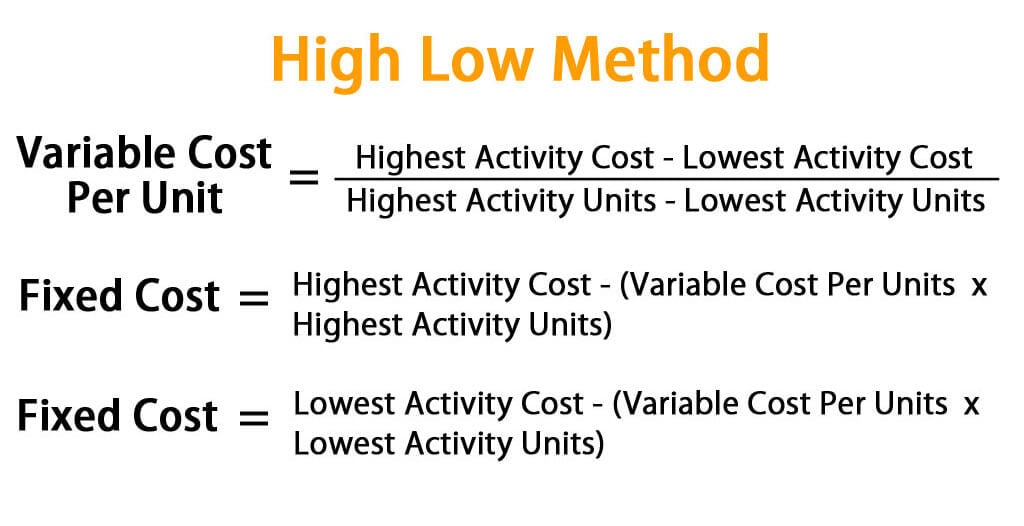

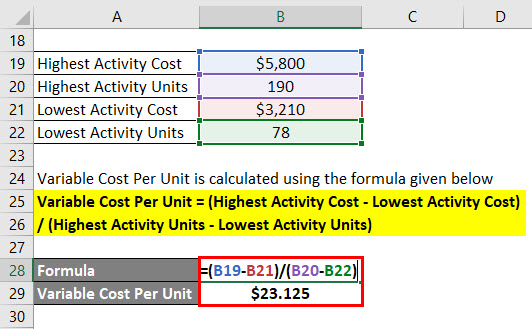

The high-low method is a simple technique for computing the variable cost rate and the total amount of fixed costs that are part of mixed costs. High Low Method In Accounting Definition.

Using the high-low method develop an estimate of fixed electricity costs per month.

. Using the high-low method develop an estimate of variable electricity costs per machine hour. HIGH-LOW METHOD Key Terms and Concepts to Know Variable Fixed and Mixed Costs. 300k-190k 110000 5500 b.

Period Semi-Variable Costs Machine Hours 1. In cost accounting a way of attempting to separate out fixed and variable costs given a limited amount of data. The High-low method is a cost accounting term that helps to separate the fixed and variable costs in case the company lacks enough data.

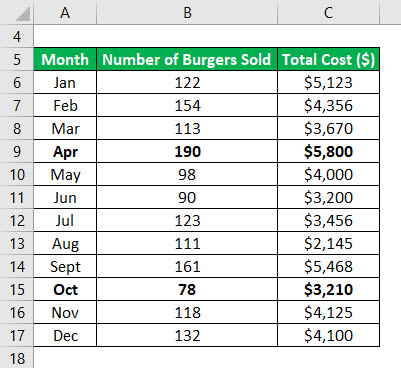

A manufacturing company estimates semi-variable costs by using the high-low method with machine hours as the cost driver. The cost of electricity was 18000 in the month when its highest activity was 120000 machine hours MHs. Machine Hours 22000 32000 26000 24000 Cost 56000 May June July August Oa.

Given a set of data pairs of. Prepare an estimate of. X Company uses the high-low method to estimate total overhead costs each month with machine hours as the activity measure.

The high-low method involves taking the highest level of. Fixed element b 5300 55. High Low Method Accounting Meaning Formula Example And More.

Course Title ACC 211. The method considers the highest and lowest. The analysis should be useful in helping predict variable and fixed costs under normal operating conditions.

Based on the following information calculate fixed costs per month using the high-low method. Recent data are shown below. High low method machine hours Saturday March 5 2022 Edit.

Using the high-low method calculate the total fixed costs for 15000 machine hours. Be sure to use the MHs that occurred between the meter reading dates appearing on the bill. Following past monthly cost and activity.

High-Low method is one of the several mathematical techniques used in managerial accounting to split a mixed cost into its fixed and variable components. Plant activity is best measured by direct labor hours. High Low Method is a mathematical technique used to determine the fixed and variable elements of historical costs that are partially fixed and partially variable.

High low method 1 machine hours maintenance costs. Ovrhd 5000Hrs 300k - 5000 5500 25000 c. Prepare an overhead cost breakdown by using the high-low method.

Mixed costs are costs that are partially. Using the high-low method. High Low Method In Accounting Definition Formula.

School The University of Queensland. Now the formula for high low method is calculated. 5000-3000 2000 Man.

Using the high-low method calculate the total costs for 15000 machine hours. Using the high-low method develop an estimate of variable electricity costs per machine hour. Barkoff Enterprises which uses the high-low method to analyze cost behavior has determined that machine hours best explain the companys utilities cost.

Quarter Work hours Cost 1 15000. Month Direct Labor Hours Maintenance Cost January 1700. Pages 55 Ratings 100 3 3 out of 3 people found.

High Low Method of Machine Hours 8000 10000 11000 9000 14000 12000 Total Maintenance Costs 600000 640000 800000 700000 900000 870000 Required.

High Low Method Learn How To Create A High Low Cost Model

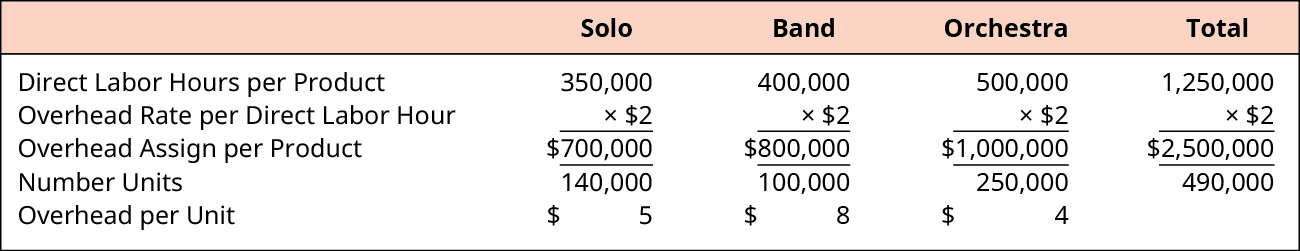

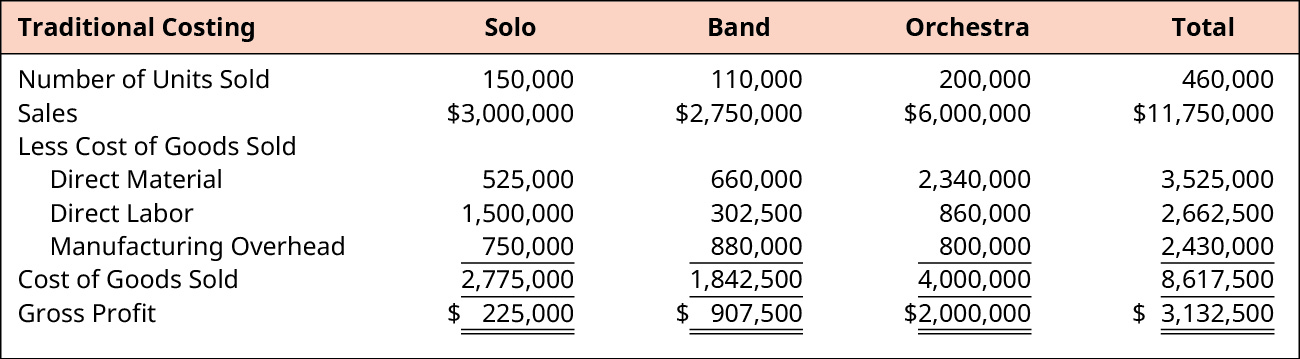

Calculate Predetermined Overhead And Total Cost Under The Traditional Allocation Method Principles Of Accounting Volume 2 Managerial Accounting

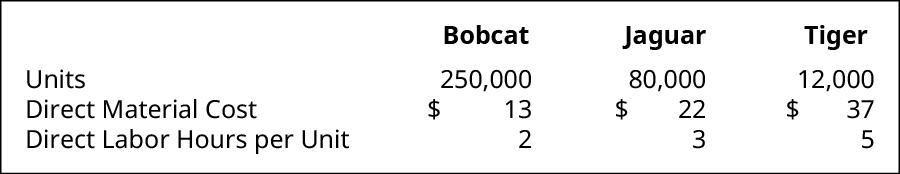

High Low Method Calculate Variable Cost Per Unit And Fixed Cost

High Low Method Calculate Variable Cost Per Unit And Fixed Cost

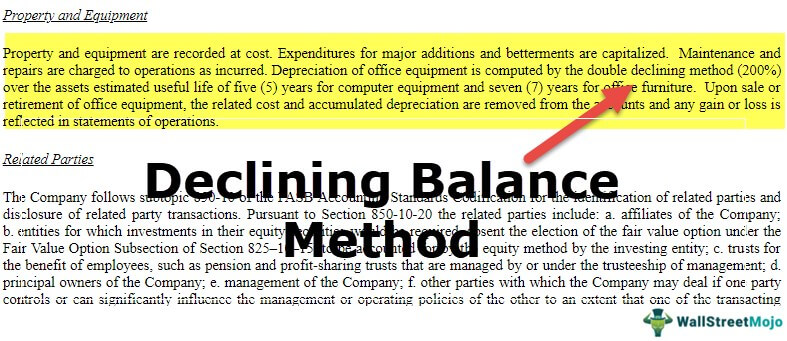

Double Declining Balance Method Of Deprecitiation Formula Examples

How To Fix Anterior Pelvic Tilt

Too Few Hospitals In Covid Hotspots Are Equipped To Offer Ecmo Shots Health News Npr

Pin On 2019 Upcoming Trending Styles

Bias Variance In Machine Learning Concepts Tutorials Bmc Software Blogs

Low Carb Paleo Indian Flat Bread Roti Indian Flat Bread High Protein Flour Low Carb Bread

High Low Method Calculate Variable Cost Per Unit And Fixed Cost

Calculate Predetermined Overhead And Total Cost Under The Traditional Allocation Method Principles Of Accounting Volume 2 Managerial Accounting

Calculate Predetermined Overhead And Total Cost Under The Traditional Allocation Method Principles Of Accounting Volume 2 Managerial Accounting

Cross Validation In Machine Learning By Prashant Gupta Towards Data Science

:max_bytes(150000):strip_icc()/PortraitHeadshot-DavidKindness-DavidKindness-2318e84654364a0584b715e44c99f13a.jpg)

:max_bytes(150000):strip_icc()/GettyImages-1301426528-0ebf6f64a7c54b058f4d37d6f19f8e44.jpg)

/cost-accounting-b615845be6d5418e8b79152f473a902f.jpg)